ebike tax credit california

30 E-bike Tax Credit. It would provide a federal tax credit of 30 percent of the purchase value of an e-bike available to an individual once every three years capped at.

E Bike Rebate Archives Calbike

The bill includes a refundable 30 tax credit for certain types of ebikes that cost up to 4000.

. The bill is short and simple. 2420 by Senator Brian Schatz of Hawaii. Any American who makes 75000 or less qualifies for a credit of up to 900 on one bike.

Electric bicycles and electric motorcycles may be. The E-BIKE Act is working its way through Congress but if passed consumers could get a tax credit worth up to 1500 on a new e-bike costing less than 8000. Knowledge Sep 1 2021.

10 federal tax credit for new ZEM purchases up to 2500. Tax credits jump to 900 for e-bikes 7500 for electric motorcycles in Build Back Better Act. This means you can buy an electric bike costing as much as 5000 or more to get the full 1500 credit.

If youre one of the many Americans who end up getting money back from the IRS around tax time this could add to your refund. The credit was originally proposed for 30. Of course a more realistic and common ebike price of 3000 could mean a tax credit of 900and a 2000 ebike might get you a 600 30 credit.

The tax credit would be available to an individual once every three years or twice for a couple that files their tax returns jointly and buys two electric bicycles. A Allowance of credit In the case of an individual there shall be allowed as a credit against the tax imposed by this subtitle for any taxable year an amount equal to 30 percent of the cost of any qualified electric bicycle placed in service by the taxpayer during such taxable year. What You Need to Know.

CalBike is working with CARB to develop guidelines for who will be eligible the size of the grants and the equitable distribution of. Couples who earn up to 150000 can buy two bikes and qualify for a. If the E-BIKE Act is eventually signed into law it would offer a 30 tax credit of up to 1500 for buying an electric bicycle.

The program would allow a 30 rebate on purchases of e-bikes that cost up to 8000. All electric vehicles must have been purchased after December 31 2009 and must acquire their energy from a battery that has a capacity of at least 5 kilowatt-hours. Allow use of pre-tax dollars to fund bike purchases and bike-share memberships.

The Plug-In Electric Drive Vehicle Credit 30D provides credit between 2500 and 7500 in nonrefundable tax credit for qualifying vehicles. 15 on the purchase of new e-bikes the first 5000 up to 750 benefit value. Shop Americas 1 Ebike Brand.

Clean Vehicle Rebate Program CVRP Eligible Vehicles. Both bills have the same goal which is to allow a. Furthermore bills in California AB 2667 and New York A10974 were introduced in 2020 to provide rebates or point of sale discounts.

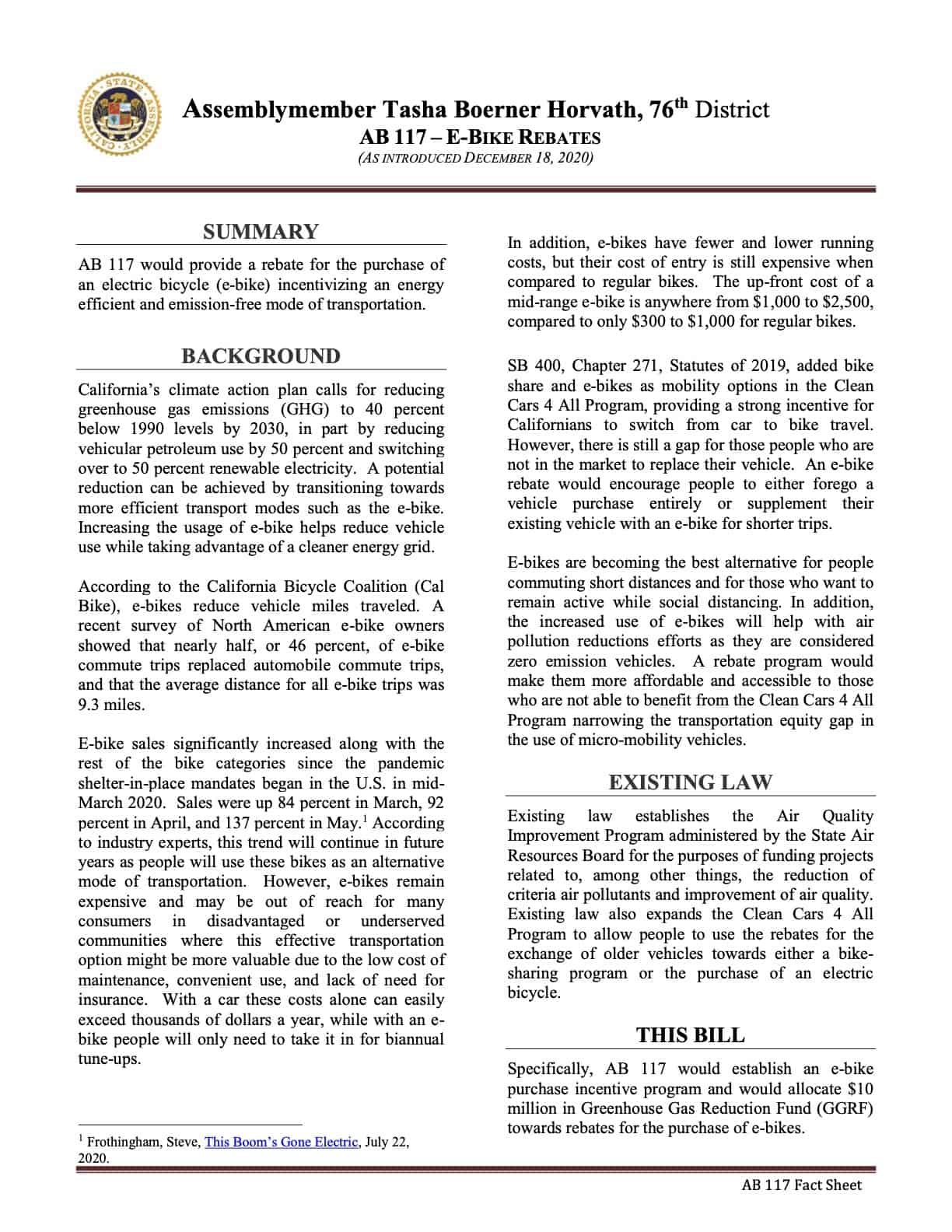

In 2019 California based SB 400 was signed into law which allowed air districts to include e-bikes in the Clean Cars for All program giving low income households the ability to scrap an old car for a subsidized purchase of one or more e-bikes. The program is scheduled to begin in July of 2022. California Clean Fuel Reward CCFR Reward of up to 1500 at the time of purchase for eligible new zero emissions motorcycles.

California congressman wants to introduce a tax credit for e-bike purchases. If passed this legislation would provide a tax credit of 30 percent off up to 1500 a new electric bike priced at under 8000. B Limitation.

1019 by California Representative Jimmy Panetta and is once again gaining momentum thanks to 21 co-sponsors and a companion bill by the same name introduced in the US. Californias E-Bike Affordability Program provides 10 million in subsidies to help people buy e-bikes. Compare Our Different Cycles and Find the Right One for You.

Free Shipping and 0 APR Available. E-bike tax credit. As stated you might get up to a 1500 credit to defray 30 of the cost of an electric bike.

If youre eyeing a new Rad model thats a potential average credit of 449 in your pocket.

E Bike Act Could Slash Cost Of E Bikes By 1 500

E Bikes Buyers Would Get Tax Credit Under Democrats Reconciliation Plan The Washington Post

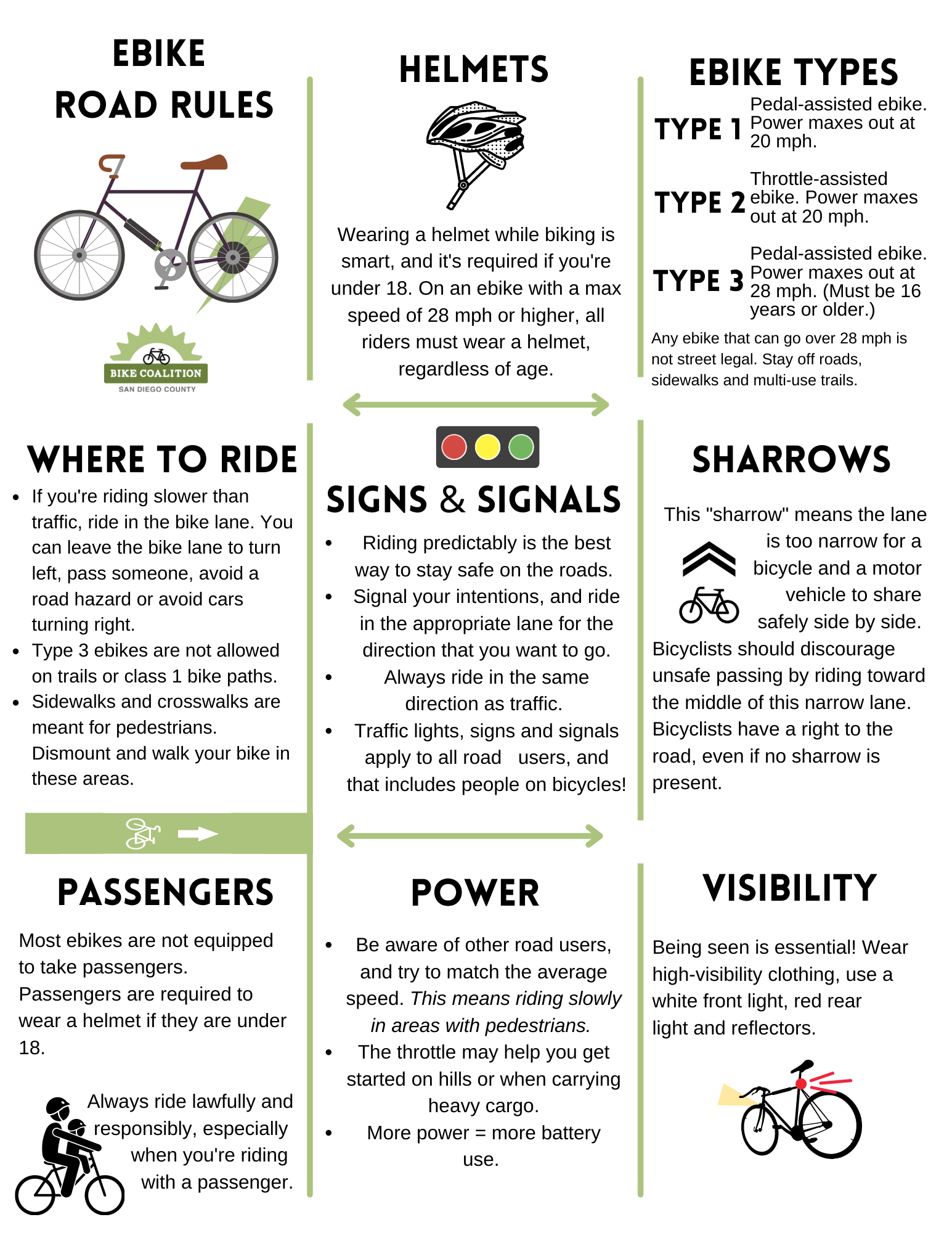

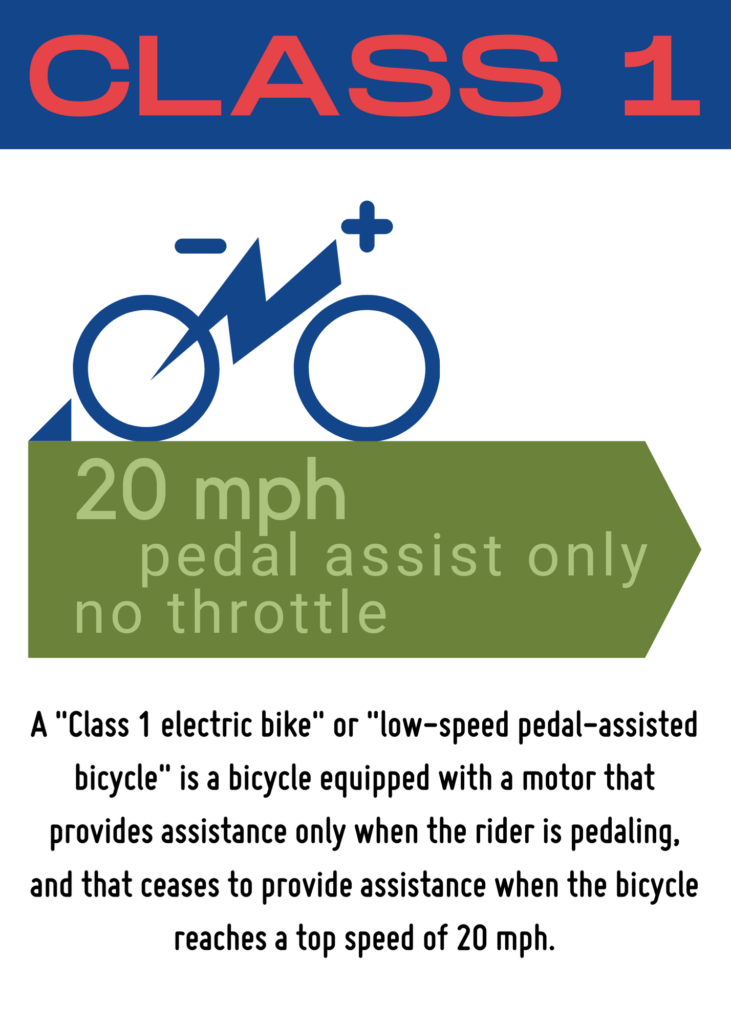

Ebike Classifications And Laws San Diego County Bicycle Coalition

E Bike Rebate Archives Calbike

E Bike Purchase Incentives Calbike

The Electric Vehicles We Need Now Are E Bikes Bloomberg

E Bike Act Could Slash Cost Of E Bikes By 1 500

Congressman Panetta Introduces E Bike Act To Encourage Use Of Electric Bicycles And Reduce Carbon Emissions Congressman Jimmy Panetta

House Committee Advances Electric Bicycle Tax Credit And Bike Commuter Benefit Peopleforbikes

Ebike Classifications And Laws San Diego County Bicycle Coalition

House Committee Advances Electric Bicycle Tax Credit And Bike Commuter Benefit Peopleforbikes

Understanding The Electric Bike Tax Credit

E Bike Rebate Archives Calbike

E Bike Purchase Incentives Calbike

Sb 400 E Bike Voucher Faqs Calbike

Biden S Compromise Legislation Platform Returns E Bike Tax Credit To Original Rate Bicycle Retailer And Industry News

/cdn.vox-cdn.com/uploads/chorus_asset/file/22320242/1212203103.jpg)

E Bikes Are Expensive But This Congressman Wants To Make Them More Affordable The Verge

House Committee Advances Electric Bicycle Tax Credit And Bike Commuter Benefit Peopleforbikes